RESIDENCE AND TAX LIABILITY

BASIS OF CHARGE

According to Sec. 4

of the Income Tax Act, Income-tax is charged on the income of an assessee

earned in the previous year according to the rates fixed by the Finance Act.

The tax liability is determined on the basis of the residence in India in the

previous year. The residential status of an assessee need not be the same each

year. The rules determining the Residential Status are not the same for all the

assesses. An assessee may earn his income in India or outside India or at both

places. Which income is assessable in India depends on the residential status

of an asseseee.

The scope of the

total income of an assessee along with his residential status is determined

with reference to his residence in India in the previous year.

There are separate rules for determining the residence of different kinds of assessees. The different kinds of assesses are individuals, Hindu Undivided families, firms, an association of persons, companies, local authorities and artificial juridical persons.

INDIVIDUALS:

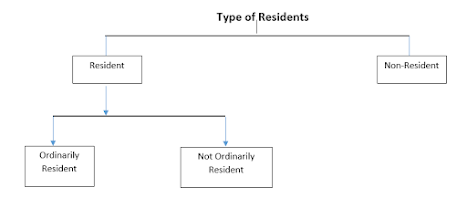

First of all, an

individual is classified as resident or non-resident and again a resident

individual may further be categorized as Ordinarily Resident or Not Ordinarily

Resident in India.

Resident in India

An individual is said to be a resident in India, if he satisfies any one of the following basic conditions – [Sec. 6(1)]

i) He is in India in the previous year for a period of 182 days or more or

ii) He is in India for a period of 60 days or more during the previous year and for 365 or more days during 4 previous years immediately preceding the relevant previous year.

An assessee who is

not satisfying Sec. 6(1) shall be treated as a non-resident in

India for the relevant previous year.

EXCEPTIONS TO THE ABOVE RULE OF 60 DAYS STAY IN INDIA

In the following

cases, condition (ii) of sec. 6(1) is irrelevant: If

1. An Indian

citizen, who leaves India during the previous year for employment purpose.

2. An Indian

citizen, who leaves India during the previous year as a member of crew of an

Indian ship.

3. An Indian citizen

or a person of Indian origin*, who normally resides outside India, comes on a

visit to India during the previous year.

Above assessee shall be treated as resident in India only if he resides in India for 182 days or more in the relevant previous year.

ADDITIONAL CONDITIONS TO TEST WHETHER RESIDENT INDIVIDUAL IS ‘ORDINARILY RESIDENT OR NOT ORDINARILY RESIDENT’ [SEC. 6(6)]

i) Resident and ordinarily resident in India

ii) Resident but not ordinarily resident in India

Resident and

ordinarily resident

If a resident

individual satisfies the following two additional conditions, he will be

treated as resident & ordinarily resident in India –

i) He has been resident in India [as per sec. 6(1)] in at least 2 out of 10 previous years immediately preceding the relevant previous year; and

ii) He has resided in India for a period of 730 days or more during 7 previous years immediately preceding the relevant previous year.

To be a Resident & Ordinarily resident in India, one has to satisfy at least one condition of sec. 6(1) & both the additional conditions of sec. 6(6).

Resident but not ordinarily resident

If a resident individual

does not satisfy both additional conditions as given u/s 6(6), he is

“Resident but not ordinarily resident in India”.

HINDU UNDIVIDED

FAMILY (HUF) [SEC. 6(2)]

An HUF can be either a resident or non-resident in India. Again, a resident HUF can further be classified as ‘Ordinarily resident’ and ‘Not ordinarily resident’.

Resident HUF: When the control & management of affairs of HUF is wholly or partly situated in India during the relevant previous year, then it is treated as resident in India.

Control & management means -

• controlling &

directive power;

• actual control

& management (mere right to control & manage is not enough);

• central control

& management and not the carrying out of day to day affairs.

The place of central control & management is situated where the head, the seat & the directing power is situated.

Non-resident HUF: An HUF is non-resident in India if the control & management1 of its affairs is wholly situated outside India.

Ordinarily

resident in India: If the ‘karta’ or

manager of a resident HUF satisfies both additional conditions given u/s 6(6),

HUF is said to be an ordinarily resident. If the ‘karta’ or manager of a

resident HUF do not satisfies both additional conditions given u/s 6(6), HUF is

said to be a not-ordinarily resident.

COMPANY [SEC. 6(3)]

Resident Company:

An Indian company is always a

resident in India.

A non-Indian company

is said to be a resident in India, if its place of effective management, in

that year, is in India.

“Place of effective

management” means a place where key management and commercial decisions that are

necessary for the conduct of the business of an entity as a whole, are in

substance made.’

Non-Resident Company: If place of effective management, in that year, is not in India, the said company is nonresident in India for the relevant previous year.

In case of company, there is no sub-division like ‘Ordinarily resident’ or ‘Not ordinarily resident’.

FIRM OR AN ASSOCIATION OF PERSONS (AOP) OR BODY OF INDIVIDUALS (BOI) [SEC. 6(4)]

Resident: A firm or an AOP or BOI is said to be a resident in India, if control & management of its affairs are wholly or partly situated in India during the relevant previous year.

Control &

management is vested in hands of partners in case of firm and principal officer

in case of an AOP/BOI.

Non-resident: If control & management of its affairs are situated wholly outside India, then it is a non-resident in India.

In case of firm or BOI or AOP, there is no subdivision like ‘Ordinarily resident’ or ‘Not ordinarily resident’.

ANY OTHER PERSON

Resident: Any other assessee will be treated as resident in

India if the control & management of its affairs is situated wholly or

partly in India.

Non-Resident: If control & management of affairs of the assessee, are situated wholly outside India, it is a nonresident in India.

INCIDENCE OF TAX LIABILITY OR SCOPE OF TOTAL INCOME

Tax liability of an assessee is based on his residential status and time of accrual or receipt of income.

I. In case of ordinarily resident: An ordinarily resident in India is assessible to tax in respect of the income which:

(a) is received or deemed to be received in India in the previous year by or on behalf of such person, whether accrued or arose anywhere; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year, whether received anywhere; or

(c) accrues or arises to him outside India during such year.

II. In case of not ordinarily resident: An not ordinarily resident in India is assessible to tax in respect of the income which:

(a) is received or deemed to be received in India in the previous year by or on behalf of such person, whether accrued or arose anywhere; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year, whether received anywhere; or

(c) accrues or arises to him outside India from a business controlled in or a profession set up in India.

III. In case of non-resident: An non-resident in India is assessible to tax in respect of the income which:

(a) is received or deemed to be received in India in the previous year by or on behalf of such person, whether accrued or arose anywhere; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year, whether received anywhere; or

Received

The term ‘received” means the receipt of income on the first

occasion. The place of its receipt shall be the place where it is received for

the first time and not the place of its receipt on subsequent remittance. Thus,

the foreign income of a non-resident in not taxable even if it is remitted to

India unless it is received or deemed to be received in India.

Deemed to be received

‘Deemed to received ‘ means that the income has not been

actually received, but it is deemed to received under the Income Tax Act.

Accrue or Arise

Accrue or arise mean right to receive the income as against

receipt of income.

Deemed to Accrue or Arise

The words ‘deemed to accrue or arise’ mean that the income has actually not accrued or arisen in India but it is deemed to accrue or arise in India under the Income Tax Act. Under section 9 (1), the following incomes are deemed to accrue or arise in India.

- Income is deemed to accrue or arise in India, if it accrues or arises, directly or indirectly

- Salary earned in India and received outside India.

- Salary payable by the government to a citizen of India for service outside India.

- Dividend paid by an Indian Company outside India.

- Income by way of Interest.

- Income by way of royalty.

- Income by way of fees for technical services.

- Certain income being any sum of money paid or any property situated in India transferred on or after 5-7-2019 by a person resident in India to a person outside India shall be deemed to accrue or arise in India.

The income from following shall not be deemed to accrue or arise

in India for non-residents:

Ø Merely purchase of goods in India for

export.

Ø Collection of news and views in

Indian for transmission out of India for the business of running a news agency

or publishing magazines etc.,

Ø Shooting of a cinematograph film in

India.

Tax incidence in Brief

The chart given below states the incidence of tax on income:

|

| Table showing incidence of tax |

Do Not Write below this note

=====================================

Redrafted for Educational Purpose.

Deekshith Kumar,

Assistant Professor of Commerce

Book Reference:

1. Income Tax Law and Accounts, by Dr. H. C. Mehrotra and Dr. S. P. Goyal

2. Business Taxation by Sadashiva Rao

Comments

Post a Comment