Income from House Property

Under the head 'Income from house property' the basis of charge is the annual value of property (Sec. 22)

1) consists of any buildings or lands appurtenant thereto,

2) of which the assessee is the owner and

3) which is not used for purpose of assessee's business or profession.

1. Buildings or lands appurtenant thereto

The land appurtenant to the building includes compound, play-ground, kitchen-garden, courtyard, etc. In the case of non residential building, car parking spaces, drying grounds, play grounds, connecting roads in the factory area shall be lands appurtenant to building. A land which is not appurtenant to any building does not come within the scope of this section. Income from such land is taxable under the head 'Income from other sources'.

Exceptions:

2. If building is let out to authorities for locating bank, post office, police station etc.,

3. Composite letting of building with other assets.

4. Paying-guest accommodation.

2. The assessee should be the owner of the house property

(i) The person in whose name the property is registered.

(ii) In case of a mortgage, it is the mortgagor and not the mortgagee.

Only owner of the house property is liable to pay tax. Where the assessee is the lessee of a building and he derives an income from subletting or reletting, it will be taxable under the head Income from Other Sources'.

Deemed Owners (Sec. 27): The following are deemed to be the owners of the property:

(a) An individual who transfers any house property to his or her spouse, without adequate consideration or not being a transfer in connection with an agreement to live apart, or to a minor child not being a married daughter shall be deemed to be the owner of the house property so transferred.

(b) A member of a Co-operative Society, Company or an Association of Persons to whom a building or its part is allotted or leased under a house building scheme of the society, company or association shall be deemed to be the owner of that property.

(c) A person who is allowed to retain possession of any building in part performance of a contract (referred to in the Transfer of Property Act) shall be deemed to be the owner of that building.

(d) A person having lease rights in the property under a lease extending to 12 years or more in the aggregate including the term for which the lease may be extended shall be deemed to be the owner of the property.

(e) If a person takes land on lease and constructs a house upon it, he will be deemed to be it's owner.

(f) Disputed Ownership: If the title of ownership is disputed in a court of law, the recipient of rental income or the person who is in possession of the property as the owner is treated as the owner.

(3) It is not used for purposes of assessee's business or profession

If the property or a portion of it is occupied by the assessee for the purpose of his own business or profession and the profits of such business or profession are assessable to tax, the annual value in respect of such property or portion of it is not taxable as income from house property and also nothing will be deductible as expenditure on rent of these premises in computing the profits of business or profession.

Computation of Annual Value of House Property

Definition of Annual Value: The annual value of a house property let out shall be deemed to be:

- The sum for which the property might reasonably be expected to be let from year to year or

- Where the property or any part of property is let and the actual rent received or receivable by the owner is in excess of the sum referred to in (a) the amount of rent received or receivable. Or

- Where the property or any part of the property is let and was vacant during the whole or any part of the previous year and owing to such vacancy the actual rent received or receivable by the owner is respect thereof is less than the sum referred to in (a), the amount so received or receivable.

Terms

Municipal Value: Determined by the municipality for the purpose of local tax.

Fair Rent: It is the rent which a similar property can fetch in the same or similar locality if let out for a year.

Standard Rent: Rent determined under the Rent Control Act. If the property covers under this act, its expected rent cannot exceed the standard rent. The expected rent can be equal to or less than standard rent.

Unrealized Rent: It is the rent which the owner cannot realise during the current year.

Annual value: From GAV any municipal taxes or local taxes paid by the owner is deducted.

The rent received or receivable refers to the rent received or receivable for the period for which the house is actually let out and does not include the rent for vacant period.

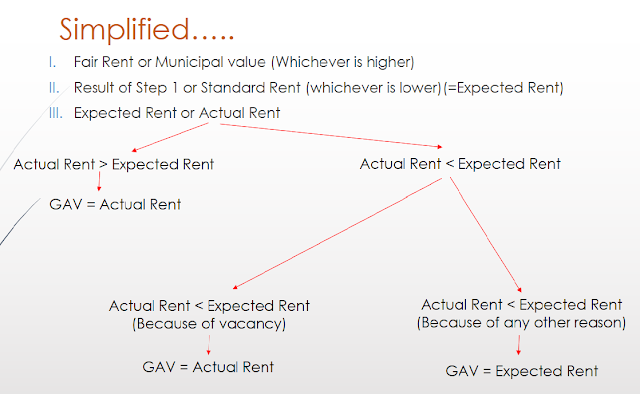

Computation of Gross Annual Value:

- Reasonable Expected Rent is taken.

- For this purpose Municipal Value or Fair rent whichever is high, but not exceeding standard rent, is considered.

- If the rent actually received or receivable for the year is higher than the expected rent, the actual rent is taken as GAV.

- If the property remains vacant during the whole or any part of the previous year and because of vacancy the rent actually received or receivable is less than the expected rent, then the rent actually received or receivable is taken as GAV.

|

| Simplified chart showing computation of Gross Annual Value |

The buildings self-occupied by the owner (an individual or HUF) for residential purposes can be divided as under:

- House or part of a house occupied by the owner for the full previous year for the purpose of his own residence or unoccupied house.

- House self-occupied for part of the previous year and let-out for part of the previous year.

- More than two houses in the occupation of the owner.

1. House or part of a house occupied by the owner for the full previous year for the purpose of his own residence or unoccupied house.

- Is in the occupation of the owner for the purposes of his own residence or

- Cannot actually be occupied by some reason, if he has to reside at that other place in a building not belonging to him

Deductions from annual value:

- If the property is acquired, constructed, repaired, renewed, or reconstructed with capital burrowed on or before 31.3.1999, the maximum limit for deduction of interest shall be Rs.30000.

- If the property is repaired, renewed, or reconstructed with burrowed capital after 31.3.1999, the maximum limit for deduction of interest shall be Rs.30000.

- If the property is acquired, constructed with burrowed capital after 31.3.1999, the maximum limit for deduction of interest shall be Rs.200000.

2. House self-occupied for part of the previous year and let-out for part of the previous year.

The annual value of self-occupied house shall not be nil if,

- The house or part of the house is let during whole or part of the year.

- If any benefit derived therefrom the owner.

In such case, the house will be be treated as let-out house under section 23(1).

3. More than two houses in the occupation of the owner.

If there are more than two houses for residence for full previous year, two houses annual value is nil (Amendments to Sec.23 and 24 w.e.f AY 2020-21). The income of other houses shall be computed in same manner u/s 23(1). The assesse should choose the houses in such a manner that his taxable income from house property is the minimum.

Deduction from the Annual Value of the House Property

1. Standard Deductions [Sec. 24(a)]

A sum equal to 30% of annual value as the standard deduction for expenses. 30% of annual value shall be deducted whether any expenditure is incurred or not. If the owner of the house occupies more than two houses for his residential purposes, standard deduction allowed. In respect of two houses which are treated as SOH, the standard deduction is not allowed.

2. Interest on loan taken in respect of house property

Interest on loan taken for purchase, construction, reconstruction or repairing the house property is allowable as a deduction on the accrual basis. Interest on unpaid interest is not deductible. Interest on a fresh loan raised to repay the earlier loan is allowable as a deduction. Brokerage or commission paid for loan is not deductible. Interest for pre-acquisition or pre-construction period

Interest payable in respect of funds borrowed for the house property pertaining to the period prior to the previous year in which such property has been acquired or constructed shall be deducted in five equal annual installments commencing from the previous year in which the house was acquired or constructed. The interest for the previous years prior to the current year, which is to be deducted in five equal annual installments, shall be deducted in addition to the interest of the current year. To sum up, total interest is, Interest of the current year + 1/5 of interest for the previous year prior to the year in which the house is constructed or purchased.

Computation of Pre-Construction period

Pre-construction period starts from the date of loan taken up to the end of financial year just preceding the year in which the construction of house property has been completed or date of repayment of loan, whichever is earlier.

Example: Mr. S burrowed Rs.500000 on 01-08-2017 at 12% p.a for the construction of his residential house which was completed on 30-06-2019. Here pre-construction period is from 01-08-2017 to 31-03-2019.

Do Not Write below this note

=====================================

Redrafted for Educational Purpose.

Deekshith Kumar,

Assistant Professor of Commerce

Book Reference:

1. Income Tax Law and Accounts, by Dr. H. C. Mehrotra and Dr. S. P. Goyal

2. Business Taxation by Sadashiva Rao

Comments

Post a Comment