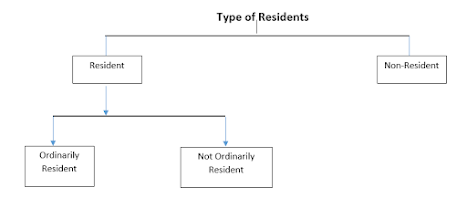

RESIDENCE AND TAX LIABILITY

BASIS OF CHARGE According to Sec. 4 of the Income Tax Act, Income-tax is charged on the income of an assessee earned in the previous year according to the rates fixed by the Finance Act. The tax liability is determined on the basis of the residence in India in the previous year. The residential status of an assessee need not be the same each year. The rules determining the Residential Status are not the same for all the assesses. An assessee may earn his income in India or outside India or at both places. Which income is assessable in India depends on the residential status of an asseseee. The scope of the total income of an assessee along with his residential status is determined with reference to his residence in India in the previous year. Residence and citizenship are two different aspects. The incidence of tax has nothing to do with citizenship. An Indian may be non-resident and a foreigner may be resident for income tax purposes. The residence of a person may cha...