Marginal Costing

Meaning

It refers to the ascertainment of marginal cost by differentiating between fixed and variable cost. It is a technique in which only variable costs are taken into account for purposes of product costing, inventory valuation and other allied important management decisions. It is developed to overcome the deficiencies of absorption costing. It is also known as variable costing.

Definition

J Batty defines, Marginal costing as, "a technique of cost accounting which pays special attention to the behavior of costs with changes in the volume of output”

ICMA, London defines Marginal Cost as, “the amount at any given volume of output by which the aggregate costs are changed if the volume of output is increased or decreased by one unit”.

It is a variable cost of one unit of a product or a service. That is, a cost which would be avoided if that unit was not produced.

Fixed costs: It remains fixed within a given range of output. They do not vary directly with rate of output. It is called Period costs.

Variable Cost: It is also called marginal cost/product cost. Total variable cost increases with the increase in output, but per unit cost remains constant at different levels of output.

- Cost Classification: In the marginal costing, all costs are classified in to fixed and variable costs.

- Variable cost consideration: In marginal costing, only variable costs are considered in the determination of the cost of the product, process or department.

- Fixed cost is considered as period cost: Fixed costs are ignored in the marginal costing, they are considered as period costs and are not included in the product cost.

- Stock valuation at marginal cost: The closing stock or work-in-progress are valued at variable cost of production, in marginal costing technique.

- Price is fixed: In marginal costing, the price is fixed based on the marginal cost and contribution.

- Concept of contribution: In marginal costing, contribution is taken as excess of sales over the variable cost. The difference between the contribution and the fixed costs is the profit or loss.

- Profitability on the basis of contribution margin: The profitability of departments, products, process is determined on the basis of their contribution margin, in the marginal costing.

- Not an independent method of costing: Like process account, operating costing, it is not an independent method of costing.

- Technique of cost control, decision making and assessment of profit: It will help in decision making and in assessment of profit. It is a technique of cost control.

Concepts of Marginal Costing

Contribution

It is the difference between selling price and marginal cost. It is the excess of the selling price over the variable cost per unit. It contributes towards the recovery of fixed cost and profit.

Profit-Volume/ Contribution-Sales/ P/V Ratio

The relation of contribution to sales is called ‘Profit-Volume/ Contribution-Sales/ P/V Ratio’. It measures the profitability of products, processes, departments etc., Profit can be increased by improving this ratio. It can be improved by increasing the selling price per unit, decreasing the marginal cost and by increasing the sales and decreasing the marginal costs.

Break-Even Point

It represents that volume of sales or production where there is no profit no loss. At this point contribution is equal to fixed costs. Sales below this point results in loss as the sales value is less than the total cost. Above this point brings profit, since the total cost is less than the sales value.

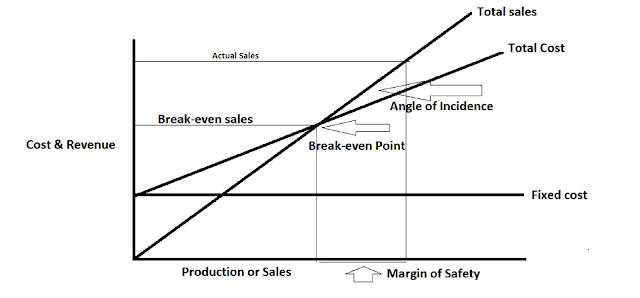

Break Even Chart

It is the graphical representation of cost and revenue showing their inter-relations at different volumes of output. It records cost and revenues on the vertical axis and the level of activity on the horizontal axis.

|

| Break-Even Chart |

Margin of Safety

It is the positive difference between actual sales and the break-even-sales. It is the excess of actual sales over the break even sales. At Break-even Point, margin of safety is nil.

It can also be expressed in percentage. It is called the margin of safety ratio.

MoS ratio ` = frac{"Margin of safety"}{"Sales"}`X 100

Angle of Incidence

It is the angle at which the sales line cuts the total cost line. It is an angle that forms between the sales line and the total contribution at the breakeven point. The size of this angle decides the extent of profit. A large angle of incidence with a high margin of safety indicates a favorable position of the firm.

Cost-Volume-Profit (CVP) analysis or Break Even Analysis.

It is a management accounting tool to show the relationship between ingredients of profit. Break even analysis refers to the analysis of relationship between cost, volume, and profit at different levels of sales or production. It is concerned with the effect of changes in costs, sales quantities, sales prices and sales mix on profits. It may be either algebraical or graphical. Algebraic method uses formula based on marginal costing equations.

Advantages of Marginal Costing

It helps in fixation of prices

Marginal costing helps in providing useful information than other costing techniques for fixing the prices. In special circumstances price may be below total cost, like trade recession or depression, heavy competition, special markets etc., And price below the marginal cost may be tolerated and production may be continued in the some circumstances.

It helps in cost control

Since the marginal cost provides variable costs and fixed costs separately, cost informations are reported periodically and regularly to controlling the costs.

It helps in making decisions

It is useful in Profit Planning

By using various concepts of marginal costing, it is easy to plan the future operations. this will help to earn maximum profit or maintain specific levels of production.

The best utilsation of such scarce resource is guided by marginal costing technique. To say, total contribution and contribution per unit of limiting factor indicate the product or products whose production is to be increased or reduced or stopped to earn the maximum profit.

It helps to make choice of profitable product mix

Marginal costing guides that the products which give the maximum contribution are to be produced in larger quantities and products which give lower contribution are to be reduced.

Contribution analysis act as a guide to decision making

Selection of methods of production, decision as to drop or to continue a product line, changes in prices, product mix are based on contribution analysis.

Performance evaluation

The performance of the individual departments, product, process etc., are evaluated through concept of contribution.

Limitations of Marginal Costing

Difficulty in classifying the cost

Perfect classification of costs, as fixed and variable is not so easy. Marginal cost is based on theses classifications.

Assumption is less realistic

Marginal costing is based on the assumption that fixed costs remain fixed and variable costs vary with the volume of production and selling price per unit remains constant at different levels of operation. These assumption are less realistic.

Ignores the fixed cost

Marginal costing ignores fixed cost in valuing stock and work-in-process. In case of loss of stock by fire full loss cannot be recovered from the insurance company and profit may also be understated in profit and loss account.

Incomplete information

Imperfect managerial tool

Cannot applied to all industries

In cannot be applied in cases of industries where the value of work in progress is very high and it cannot be used in cost plus contracts where determination of total cost is difficult. Concessional price charged to a selected customer may lead to general reduction of normal selling price and thus lead to loss.

No standard for the evaluation of the performance

It does not provide any standard for the evaluation of performance. A system of budgetary control and standard costing gives more effective control than marginal costing.

ABSORPTION COSTING

Absorption Costing is the a technique of costing, where no distinction is made between fixed and marginal costing. It is the practice of charging all costs to operations, product and processes. It is also called total input or full cost, full absorption cost, cost attach, conventional, traditional costing. It is a simple and fundamental method of ascertaining the cost of a product or service.

Under this system, the unit cost varies inversely with the volume of production. It is so because the fixed cost per unit will be reduced with the increase in output and vice verse.

Difference between Absorption Costing and Marginal Costing

1. Charging of Costs

Absorption costing is the practice of charging all costs to operations, processes or products. But, marginal costing system, only variable costs are charged to products, processes or operations. Fixed cost is treated as a period cost and is transferred to profit and loss account.

Stock of finished goods and work-in-process is valued at total cost which includes both variable and fixed costs in absorption costing. Whereas, in marginal costing stock of finished and semi-finished goods are valued at total variable cost only. This results in higher valuation of stock in absorption costing than in marginal costing.

3. Under or over absorption of costs

4. Managerial decision base

Managerial decisions are guided by profit which is the excess of sales value over total cost in In absorption costing, but marginal costing focuses its attention on contribution which is excess of sales value over variable costs.

5. Amount of attention

Absorption costing is more realistic when different products receive widely differing amount of attention. But, marginal costing is favoured in simple processing situation in which all products receive similar attention.

6. Ignorance of costs

Absorption costing avoids danger of understating importance of fixed costs, but decisions based on marginal costing system may concentrate only on sales revenue and variable costs.

==================================

Do Not Write below this note

==================================

Redrafted for Educational Purpose.

Deekshith Kumar,

Assistant Professor of Commerce

Book Reference:

1. Cost and Accounting by M. N. Arora

2. Cost and Management Accounting by Dr.S.N.Maheshwari

3. Management Accounting by M.Y.Khan & P.K.Jain

4. Cost Accounting by K.S.Adiga

Comments

Post a Comment