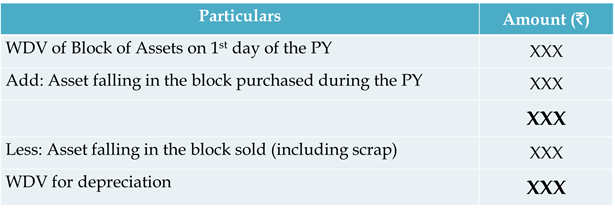

Meaning of Depreciation It refers to a decrease in the value of assets by wear and tear, caused by their use in the business over a period of time. Its cost is spread over its anticipated life by charging depreciation every year against the profits of the business. Conditions for allowance of depreciation. The asset must be owned by the assesse. It must be used for the purpose of business or profession. It must be used in the relevant accounting year. Assets eligible for depreciation A. Tangible Assets: Buildings, Machinery, Plant and furniture B. Intangible Assets: Know-how, Patents, Copyrights, Trademarks, Licences, Franchises or any other commercial rights of similar nature. Other assets like Investments, goodwill etc., do not qualify under this category. Buildings means only superstructure and does not include the land on which it is constructed. Plants includes ships, vehicles, books, scientific apparatus and surgical equipment used for the purpose of business or...